[This is a continuation of USWest's post "Secrets and Tax Lies" (4/27/06). I needed to make a separate post so I could include a chart.]

Few things anger me more than deliberate misuse of statistics, and there were some real whoppers in the NPR Marketplace Report from WSJ editorial board member Steve Moore. (Incidentally, since when does a respectable news outlet get to interview editorial staff at another news outlet and then reclassify the resulting opinion piece as news?)

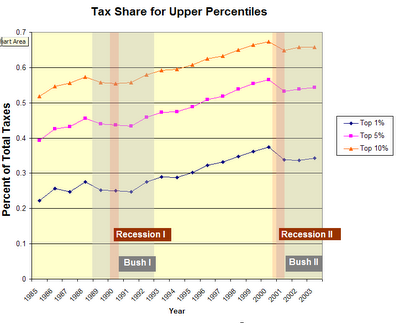

Mr. Moore said that the share of taxes paid by the rich was rising and had risen during Bush's presidency. Dubious, I went to the the IRS directly and found the actual tax data Mr. Moore had referred to, then put together some annotated charts (please click on the charts to enlarge them).

First, note that Mr. Moore conveniently made his comparisons of present day to 2001, not 2000 (the last year before the Bush tax cuts.) Had he made an honest comparison to 2000, we would see a clear drop in tax share for the rich during Bush's term in office. So Mr. Moore lied about the effect of the Bush tax cuts.

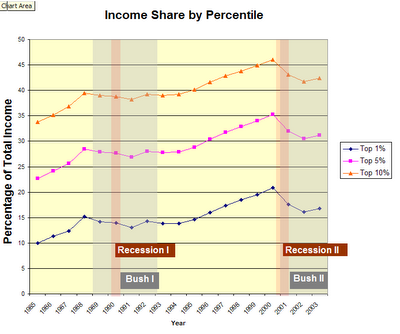

Second, one can see that the tax share of the wealthy has been rising (in general) for about 20 years... but this is not, as Mr. Moore claims, because of disproportionate tax hikes on the rich. Instead it is because of their disproportionate gains in income! Look at how neatly the income statistics below track the tax statistics above:

Third, Mr. Moore neglected corporate income tax, predominantly paid by the upper percentiles. From 2000 to 2002 (the most recent year for which the IRS gives corporate data), a combination of economic factors and Bush tax cuts reduced the total tax collected from all individual income tax returns by 18%, while during the same time, the total tax collected from all corporate income tax returns was reduced by 25%! So once again, Mr. Moore conveniently forgot to mention the extra large tax cut that the wealthy enjoyed via the corporate tax cuts.

Finally, these taxes do not simply fall into a black hole, as right-wingers would have you believe. The government spends this money and in so doing returns it to people of various income levels. And as USWest and others have pointed out, the Bush years have shifted these expenditures away from the the lower 90% by cutting services, etc. The point is, if you slice the pie honestly, the Bush tax cuts were a windfall for the rich in several ways, and even the underlying trend toward increasing high-end tax share merely reflects growing income inequality.

[Sources: "Selected Ascending Cumulative Percentiles of Returns Based on Income Size Using the Definition of AGI for Each Year." Published as: SOI Bulletin article - Individual Income Tax Rates and Tax Shares, Tables 5 and 6. And "Size and Accumulated Size of Adjusted Gross Income." Published as: "Individual Complete Report (Publication 1304), Table 1.1" Both available here. Also "SOI Tax Stats - Corporation Data by Size." Available here. ]

Friday, April 28, 2006

Secrets and Tax Lies II

Posted by Dr. Strangelove at 10:59 AM

Subscribe to:

Post Comments (Atom)

6 comments:

Excellent, Dr. Stranglove! Thanks for doing that homework for us! Good point about corporate tax rates. Frontline did a very good series on tax shelters and their effect on overall tax revenue.(Tax me if you Can ) They interviewed Robert McIntyre of the Institute on Taxiation and Economic Policy. He said, "If you look at [the average share for corporations of the total tax burden], say, from 1950 to 2000, corporations averaged about 17 percent of the federal taxes. All of a sudden now, down to 7 percent -- 7 percent of the government paid for by corporate taxes, compared to [a] quarter or a third 30 years ago, and even the whole period, 17 percent. So, yes, they're paying a whole lot less than they used to, and the rest of us are picking up the tab for it."

I wrote Marketplace and complained.

You're welcome! It's nice to have one's work appreciated (it's not easy to find this kind of data and display it in a meaningful way.) I'm glad you complained to Marketplace! Their article was rubbish.

I'd love to find similar figures for corporations, but it's much harder to find and parse the data.

Incidentally, I also looked for information on personal wealth or net assets, but a lot of that data is reported by the Census by household rather than by individual, which skews all the numbers when you try to cross-reference it with the IRS income tax statistics.

Excellent work, Dr. S. You can compare the graphs to GDP and you'll put the lie to another Republican myth, that high taxes = recession.

// posted by LTG

Great data work Dr. S! It proves the point that people are taxed, dollars are. The tax burden follows the wealth - plain and simple.

// posted by Raised By Republicans

So here's the next graph I want you to do... :)

Seriously, playing with the data (in relation to my comment on Part I), I looked at the difference between percentage of tax share and percentage of income share. (If every dollar were taxed the same amount, like a flat tax, these numbers would be the same.)

As you can tell from the good tracking, this difference for each line is roughly constant, although looking at the first data point, the point between '94 and '95, and the peak point after 2000, the difference does increase slightly. (From roughly 18% up to 22% for the wealthiest 10%.)

What's a little strange is that this difference in percentages is almost exactly the same for the 10% and 5% groups, but distinctly lower for the 1% group.

Then I tentatively decided that this is just a weird coincidence, since the really important factor is the ratio of the percentages (or, if you like, the ratio of the difference [tax share % - income share %]/[income share %]). This is a measure of the progressiveness of the tax -- how much more of the total tax burden this group is paying than the average.

Taking the ratio of the difference with the income share (which is 0 for a flat tax), we find that for the three data points I mentioned at the beginning, the ratios are all shrinking, and shrinking most for the richest 1%:

Date: 85/86; 94/95; 00/01

--------------------------------

10%: 18/34; 21/40; 22/46

5%: 18/23; 21/28; 22/35

1%: 12/10; 15/15; 17/21

For Mr. Moore's nefarious purposes, most interesting would be the results from 2000 onwards, which I haven't looked at. But up until then, the taxes were getting less progressive.

// posted by Bob

I second Bob's request.

// posted by Raised By Republicans

Post a Comment